Introduction

Cost per thousand (CPM) is a critical metric in advertising and marketing, often discussed in the context of digital media. However, it also has significant implications in the finance sector, especially when evaluating the effectiveness of marketing campaigns, assessing ROI, and driving strategic decisions. In this article, we’ll explore the concept of high CPM, its relevance in finance, and strategies to optimize CPM for better financial outcomes.

What is CPM?

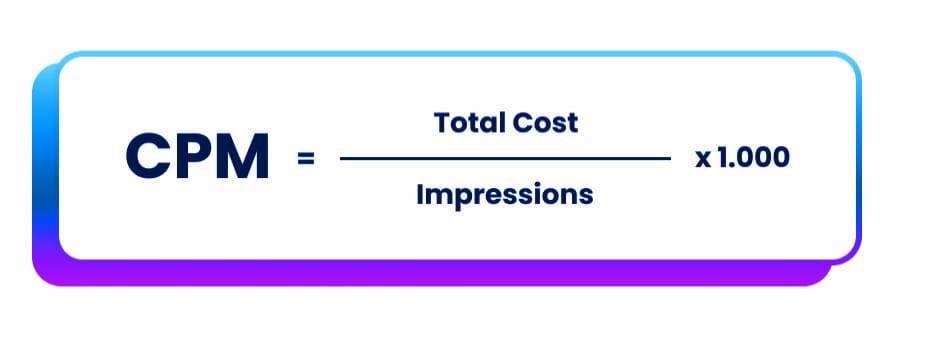

CPM, or Cost Per Mille, refers to the cost an advertiser pays for one thousand impressions of their advertisement. It is a commonly used metric in digital advertising, providing insights into the cost-effectiveness of campaigns. The formula to calculate CPM is:

[

\text{CPM} = \left( \frac{\text{Total Cost of Campaign}}{\text{Total Impressions}} \right) \times 1000

]

For instance, if a company spends $5,000 on a campaign that generates 1 million impressions, the CPM would be:

[

\text{CPM} = \left( \frac{5000}{1000000} \right) \times 1000 = 5

]

This means the company pays $5 for every thousand impressions of its ad.

Importance of CPM in Finance

In finance, understanding CPM can help businesses make informed decisions regarding their advertising budgets and strategies. Here are some key reasons why CPM is important:

- Budget Allocation: Companies can use CPM to evaluate which channels or campaigns provide the best value for money. By analyzing CPM across different platforms, businesses can allocate their budgets more effectively.

- Performance Measurement: CPM allows businesses to track the performance of their marketing efforts over time. This data can inform future campaigns and help refine strategies.

- ROI Assessment: Understanding the relationship between CPM and revenue generated from campaigns is essential for assessing ROI. A high CPM does not always equate to high revenue, so it’s crucial to analyze this metric in conjunction with conversion rates.

- Strategic Planning: Businesses can use CPM data to inform broader marketing and financial strategies, enabling them to target specific demographics more effectively.

Factors Influencing High CPM

Several factors can lead to a high CPM, including:

- Audience Targeting: More refined targeting options, such as demographics or interests, can increase CPM. Advertisers willing to pay for highly targeted audiences often see better conversion rates despite higher costs.

- Competition: High competition in certain industries can drive up CPM. For example, sectors like finance and insurance often have high CPMs due to intense competition for consumer attention.

- Ad Quality: High-quality ads that resonate with audiences can lead to increased engagement, potentially resulting in a higher CPM but better overall performance.

- Seasonality: Certain times of the year, such as holidays or events, can lead to increased advertising spend and higher CPMs due to heightened competition for visibility.

- Platform Type: Different platforms have varying CPM rates based on their audience reach and engagement levels. For instance, social media platforms may have different CPMs compared to traditional media outlets.

Strategies to Optimize CPM

To manage high CPM effectively and improve financial outcomes, consider the following strategies:

- Enhance Targeting: Use advanced analytics to better understand your audience. Tailoring campaigns to specific demographics can improve engagement and lower CPM over time.

- Optimize Creative Content: Invest in high-quality creative content that attracts attention and resonates with the target audience. A compelling ad can increase click-through rates (CTR) and, subsequently, lower CPM.

- A/B Testing: Implement A/B testing for different ad formats, placements, and messaging to identify what performs best. This iterative process can lead to more effective campaigns and reduced CPM.

- Leverage Data Analytics: Utilize data analytics tools to monitor and analyze campaign performance. Insights gained can guide budget adjustments and strategy refinements.

- Diversify Advertising Channels: Relying on a single advertising channel can expose businesses to high CPM risks. Exploring a mix of digital, print, and broadcast media can balance costs and effectiveness.

- Utilize Retargeting: Retargeting ads can effectively lower CPM by reaching users who have previously interacted with your brand. These ads tend to have higher engagement rates, improving overall campaign performance.

Case Study: A Practical Example

To illustrate the impact of high CPM in a financial context, consider a fictional finance company, “FinCorp,” that launches a new investment product. The company allocates a budget of $50,000 for a digital marketing campaign across various channels, including social media, search engines, and financial news websites.

Initial Analysis

Upon launching the campaign, FinCorp finds that:

- Social Media: $20,000 spent, generating 2 million impressions (CPM = $10)

- Search Engines: $15,000 spent, generating 1 million impressions (CPM = $15)

- Financial News Websites: $15,000 spent, generating 750,000 impressions (CPM = $20)

Evaluation

While the search engine and financial news campaigns have higher CPMs, they also result in higher conversion rates:

- Social Media Conversions: 100 leads (5% conversion)

- Search Engine Conversions: 150 leads (10% conversion)

- Financial News Conversions: 50 leads (3.33% conversion)

Strategic Decision

Given this data, FinCorp can conclude that:

- Despite the higher CPM, search engine advertising is yielding the best ROI, as it produces the highest number of leads per impression.

- Social media ads, while cheaper, are not converting as effectively.

- Financial news websites, despite the high CPM, are not generating sufficient leads to justify the cost.

Adjusting the Strategy

Based on these insights, FinCorp decides to:

- Increase Budget for Search Engine Marketing: Allocating more funds to search engines could amplify their lead generation efforts.

- Refine Social Media Targeting: Improving audience targeting on social media may enhance conversion rates without drastically increasing CPM.

- Evaluate Financial News Spend: Consider reallocating budget from financial news websites to channels showing better performance.

Conclusion

Understanding and optimizing CPM is crucial for financial decision-making in advertising. A high CPM can indicate effective targeting or intense competition, but it doesn’t always correlate with success. By strategically managing CPM and focusing on data-driven decisions, companies can improve their ROI, enhance marketing effectiveness, and ultimately drive financial success.

In today’s digital landscape, the ability to analyze and adapt strategies based on CPM insights will distinguish successful organizations from their competitors. With the right approach, businesses can turn high CPM into an opportunity for growth and enhanced financial performance.